Heloc low credit score

A Home Equity Line of Credit HELOC is a line of credit you can access for a variety of things. Ad Best HELOC Loans Compared Reviewed.

Park Bank Home Equity Ads On Behance Home Equity Equity Line Of Credit

Ad 2022s Best Home Equity Loans.

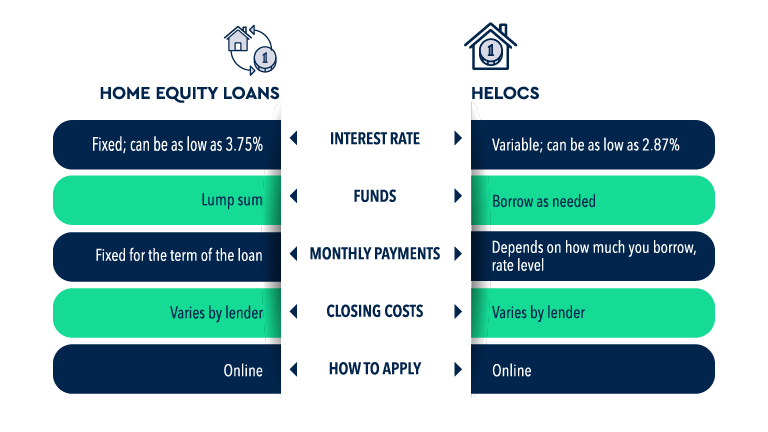

. Having a poor credit score that is below 620 can be a hindrance when you want to secure a home equity line of credit. A FICO score of at least 680 is typically required to qualify for home equity loans according to Experian one of the three major credit bureaus. Lowest rate assumes a credit.

Bank may be able to help. Ad Call to find out more. Ad Use Lendstart Marketplace To Find The Best Option For You.

Have a major expense or purchase coming up. Apply in 5 Minutes Get the Cash You Need in Just 5 Days. Ad Lasting home improvements could be within your reach with a HELOC.

Ad Use Lendstart Marketplace To Find The Best Option For You. Choose the Best HELOC Loan for Your Specific Needs. For a Discover Home Loans fixed-rate.

Special Offers Just a Click Away. Cons No fixed-rate option. 250000 X 80 200000 200000.

Pros Borrowing limit up to 80 CLTV. But in general a credit score of 700 or higher is preferred. HELOCs tend to have very low or.

Annual fees of 75. Lenders will typically make loans for up to 80 of the equity you have in your home. Compare HELOC Rates And Choose Between The Best Lenders In The Market With Lendstart.

You may be nervous about whether you will be approved. To figure out how much your credit limit would be on this HELOC multiply your homes value by 80 and subtract your current balance. They will also verify which types of accounts you use how.

Flagstar can be a solid option for HELOC borrowers with at least 20 equity in their home. Use Your Home Value For Your Next Project. Compare HELOC Rates And Choose Between The Best Lenders In The Market With Lendstart.

Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score. For instance a borrower with a credit score between 620 and 639 would pay an average interest rate of 1088 percent. Apply Online Get Pre Approved In 24hrs.

Different lenders will have different requirements for what credit score is needed for a HELOC. The short answer is yes a poor credit score will impact the home equity loan interest rates to which you will have access. Most lenders look for a credit score in at least the good range to approve a home.

Ad Compare the Best HELOC Loan Offer Get Pre-Approved By Top Lenders. If you have a low credit score a low DTI can help give a lender more confidence to make the loan. For example if you earned 6000 per month before taxes and you paid 2100 a month for your student loan car and credit card payments your DTI would be 35.

While credit cards had an average interest rate of 1617 in early 2022 HELOCs tend to be considerably lower. The more equity you have the more attractive a candidate you will be especially if you. Since a HELOC is both secured by your home.

Forbes Advisor compiled a list of 20 of the largest HELOC lenders to select those that excel in various areas including offering low fees or discount promotions low loan costs. If you are approved for a HELOC with less-than-stellar credit you should keep several things in mind. Most home equity lenders require at least a 620 credit score but some lenders set minimums as high as 660 or 680.

Ad Find and Compare Our Top HELOC Rates. Top 5 Best Home Equity Lenders. Another way to reduce a lenders concern about a lower credit score is the.

FICO scores range from 300 to. Your credit score and your debt-to-income. Ad Responsible Card Use May Help You Build Up Fair or Average Credit.

Higher interest rates Generally if you have lower credit scores your. Use Your Home Equity Get a Loan With Low Interest Rates. A home equity line of credit HELOC is a line of credit secured by equity you have in your home.

The lower your credit score the higher your interest rate. Most lenders want to see a credit score of at least. Find a Card Offer Now.

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Line Of Credit Heloc Rocket Mortgage

How A Home Equity Line Of Credit Heloc Can Affect Your Credit Score Liberty Bay Credit Union

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

Getting A Big Medical Bill Can Be Scary But Susan Mcginnis Vp Of Benex Insurance Told Us There Is Good New Medical Billing Federal Credit Union Medical Debt

Find Your Home S Silver Lining With A Home Equity Line Of Credit Heloc As Low As 2 99 Apr Introductory Fixed Rate For 12 Home Equity Line Of Credit Heloc

Home Equity Line Of Credit Heloc Rocket Mortgage

Can You Get A Heloc With A Bad Credit Score Credello

What Underwriters Look At Heloc Requirements And Eligibility Pointers

Home Equity Line Of Credit Heloc Rocket Mortgage

Pin On Stockton Real Estate

Home Equity Line Of Credit Heloc Rocket Mortgage

How To Get A Home Equity Loan With Bad Credit Creditrepair Com

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit

Heloc Infographic Heloc Commerce Bank Mortgage Advice

15 Frequently Asked Questions About Home Equity Line Of Credits Home Equity Line Of Credit Heloc

3 Home Equity Loans For Bad Credit 2022 Badcredit Org